This strategic move not only enhances operational resilience but also supports scalability and innovation, enabling financial institutions to better serve their clients and respond swiftly to market changes. It’s important to choose the right https://www.quick-bookkeeping.net/cost-driver-know-the-significance-of-cost-drivers/ partner to ensure every employee is paid securely, on time and accurately every month. Financial analysts provide unbiased and objective financial performance assessments, helping businesses identify areas of strength and weakness.

Information technology

With a rigorous vetting process in place, Wishup ensures that you only get to work with the top 1% of the talent in the industry. Their virtual assistants are highly skilled, experienced, and capable of delivering exceptional bookkeeping services. Moreover, the platform provides easy communication and coordination channels between clients and freelancers. With their project management tools, you can streamline tasks, provide feedback, and ensure precision and efficiency in the execution of your critical financial decisions. We dug deep, investing countless hours, and personally tested numerous platforms to bring you this carefully curated collection of the top seven. But what if we told you, you could easily delegate these critical financial tasks to highly-trained experts without a burning hole in your pocket?

How To Outsource SEO: Costs And Considerations

The industry is poised for a dynamic transformation, driven by a combination of technological innovation and strategic adaptation to regulatory changes. This approach ensures that outsourcing arrangements remain in line with legal requirements and industry standards. A robust risk management strategy for outsourcing financial services involves identifying, assessing, and mitigating potential risks. This includes implementing redundant systems, continuous monitoring, contractual safeguards, and comprehensive contingency plans to ensure business continuity and minimize the impact of unforeseen challenges.

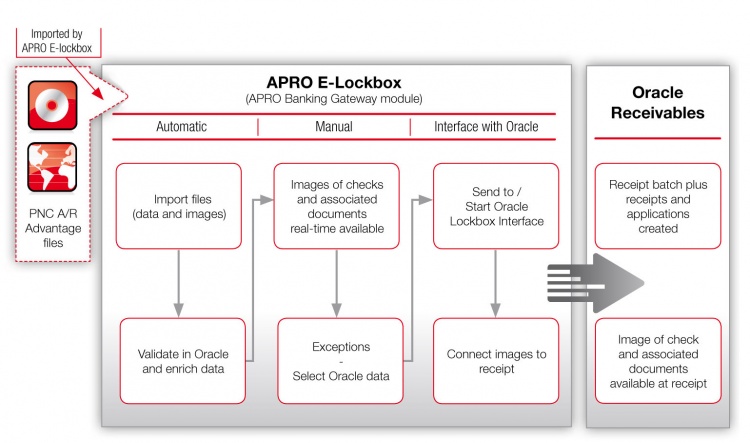

Solution Title

Outsourced tax specialists provide expertise in tax planning, preparation, and compliance. They stay updated on tax regulations and help businesses minimize tax liabilities while ensuring compliance with tax laws. As billing needs change, companies can easily adjust the level of the service supplied by outsourced specialists. Whether scaling up during busy periods or adapting to changes in billing requirements, outsourcing offers the flexibility to meet evolving business needs. Many U.S. firms are outsourcing accounting and bookkeeping services to address this local shortage of accountants.

Discover the Top 5 Benefits of RPO Payroll Services

It is therefore difficult to separate the wheat from the chaff, and many companies get burned trying to find the right partner themselves. Unlock the full potential of outsourcing with ease and discover the perfect fit for your organization. Our comprehensive range of offshore roles can help streamline your operations and make outsourcing simple. We have 13 locations in purpose-built hubs across the Philippines, giving you the best performance and talent pool possible.

Lokation Real Estate’s Journey to Success with Ossisto – Case study

- Outsourcing solves these challenges, allowing businesses to streamline operations and focus on their core activities.

- From humble beginnings, the global outsourcing market has grown at a rapid rate as governments realize the economic benefits of providing services for other nations.

- Due to a lack of funding, these firms may find it challenging to offer competitive salary packages compared to larger financial institutions like banks.

- In addition to traditional accounting services, our dedicated team of CPAs brings top-tier customer service skills to the table, helping to boost revenues and drive business growth.

Thoroughly evaluate proposals from potential outsource accounting companies or outsourcing partners. Consider factors such as expertise, experience, references, scalability, and the alignment of their offerings with the company’s needs. This comprehensive evaluation ensures that the selected outsource accounting partner possesses the necessary skills and resources to meet specific financial requirements. Examining expertise and alignment with company needs 9 tax audit red flags for the irs is particularly critical when considering outsource accounting companies, as it directly impacts the precision and effectiveness of financial operations. In today’s fast-paced business environment, financial services firms are increasingly turning to outsourcing to help them stay competitive. Outsourcing financial services, also known as fintech outsourcing, involves hiring a third-party provider to handle tasks that would normally be handled in-house.

One of the most effective ways to address talent shortages is by investing in retraining and upskilling existing employees. The next generation of workers has different expectations and demands from their employers, and if the industry fails to adjust, the shortage will persist. The U.S. Bureau of Labor Statistics estimates that nearly 400,000 employees will retire from the insurance workforce in the coming years, leaving a significant talent gap.

For successful team structures, local market recruitment advice and suggested staff to leader ratios, select one of the common teams that can be easily outsourced to the Philippines below. They are primarily responsible for overseeing all finance functions to ensure the financial health of your organization. If you’re considering outsourcing all your finance functions to a single individual, let us be the first to tell you that’s not the way to go. Regulatory landscapes evolve, and companies need to continuously monitor changes in regulations. Regular assessments of the outsourcing partner’s compliance status and practices are essential to adapt to regulatory updates.

Establishing clear communication channels specific to outsourced financial services enhances the understanding between the business and potential partners, facilitating a more collaborative and effective RFP process. This transparency promotes a shared comprehension of expectations and requirements, contributing to the selection of an Financial Services Outsourcing partner that best aligns with the company’s financial service needs. Payroll professionals from BPOs are trained professionals who specialize in handling payroll processing, tax filings, and employee benefits administration. By entrusting these tasks to external providers, businesses can ensure that their payroll processes are efficient, accurate, and compliant with regulatory requirements.

The right outsourced accounting firm and Finance as a Service provider should not only understand the financial side of your business but also have the knowledge and insight into your industry. They should be able to fill your finance and accounting gaps with modern software solutions and best practices. They should also be prepared to learn the complexities and uniqueness of your business, along with its specific financial goals. Proven, Streamlined Processes and Controls – Great providers create value and give you a competitive advantage through business process excellence. It’s important to note that the new habit many businesses have developed of outsourcing financial services to an outsourcing provider is well-founded.

If you’re seeking financial analysts with knowledge and experience in a particular industry or market, Upwork allows you to narrow down your search based on those criteria. You can specify the industry or market you operate in, ensuring that the financial analysts you find understand the unique dynamics and challenges of your specific field. Wishup also makes sure these professionals are well-versed in over 70+ accounting software and tools, including QuickBooks live https://www.accountingcoaching.online/ bookkeeping, Zoho, FreshBooks, and Xero. That means they can seamlessly integrate into your existing workflows, making your life easier and your bookkeeping processes smoother than ever. So, after all that hard work and thorough investigation, we present you with this carefully curated collection of the top seven platforms to outsource your financial services. We’ve done the legwork, so now you can sit back, relax, and make an informed decision that suits your needs.

Their insights enable companies to capitalize on opportunities, mitigate risks, and optimize financial strategies to achieve their goals. Outsourcing Is An InvestmentYour business is unique and has its own set of outsourced accounting needs. That’s why AccountingDepartment.com calculates a monthly fee for you after reviewing company’s existing accounting files, followed by a conference call to review the results of this review.

TAGS: